C is for Clarifying the Calculation, Part II: Reality Check

C is for Clarifying the Calculation, Part II: Reality Check

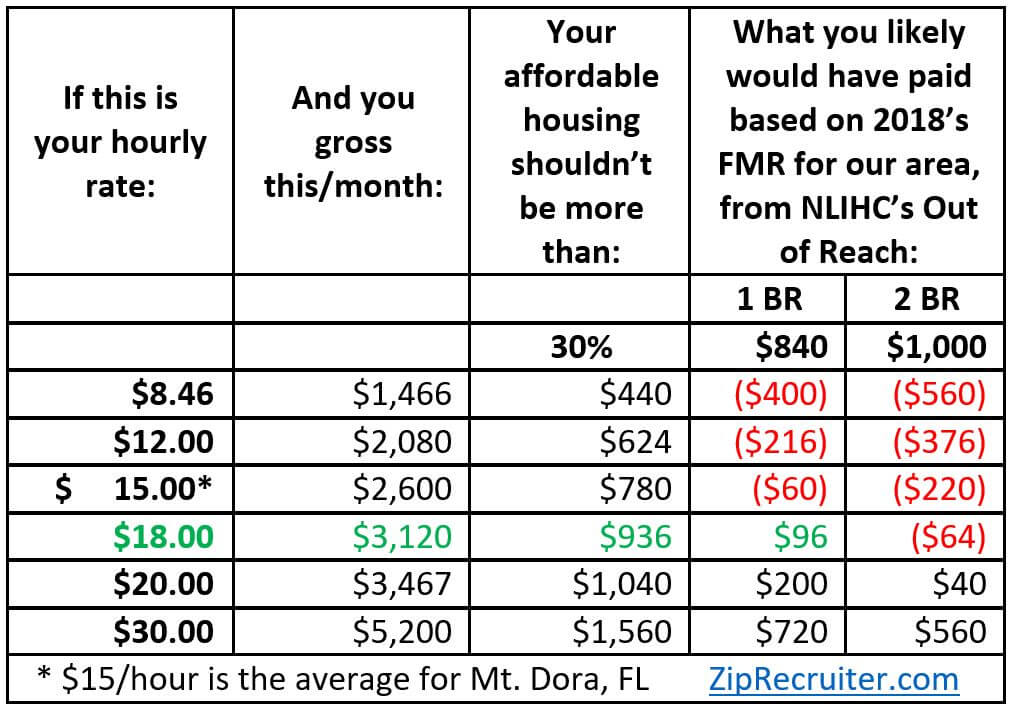

In our last article we looked at the AMI, Area Median Income, and learned that the AMI for Lake County is $62,900 ($30.24/hour based on 40 hours/week, 52 paid weeks/year). Pop quiz: what does ‘median’ mean? It’s not the average; it means that half make more, half make less.

Median income drives the entire conversation on affordable housing. Pop quiz: What does the term ‘affordable housing’ mean? It means that no more than 30% of gross household income is spent on rent/utilities or, in the case of home ownership, PITI (principle, interest, taxes, and insurance). Why? Because everyone needs room in their budget to pay for other expenses.

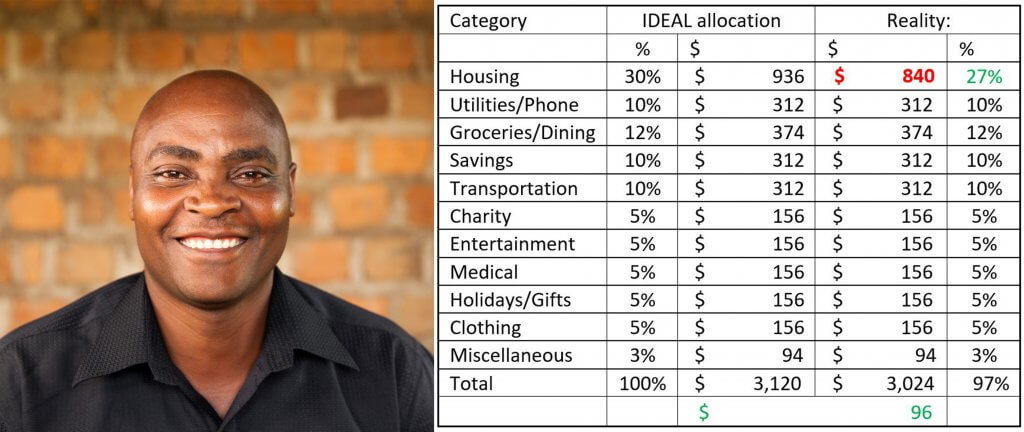

Using the chart below, we see that someone earning the median income for Lake County would be able to afford the Fair Market Rent (FMR) for housing. What about those earning less than the median? Let’s walk through those numbers. The chart is based on the following details:

Florida’s 2019 minimum wage is $8.46

Florida’s 2019 minimum wage is $8.46- The Fair Market Rent (FMR) is from the National Low Income Housing Coalition’s (NLIHC) annual Out of Reach data for housing costs in zip code 32757 (at the site, click on the zip code for detailed information)

- The 1 BR and 2 BR columns show the difference between the affordable, 30% housing number (what you’d ideally pay) and the actual Fair Market Rent

- Income is pre-tax, based on 52 paid weeks/year at 40 hours/week, no overtime

How does paying more than 30% affect the rest of someone’s finances? Let’s look at three theoretical budgets for a single person renting a one bedroom home. We’re using percentage allocations commonly recommended by professional planners. Are you ready to see what those earning less than the median income are dealing with?

Maria Garcia’s Budget

$8.46/Hour (Minimum Wage): Annual Gross Income $17,597: Monthly Gross Income $1,466

- What are your assumptions about making a living on minimum wage?

- Study the numbers. Could YOU “make it” on this income?

- Which category looks too low?

- Ask others what they think.

- Spending 57% of gross monthly pay on rent (27% more than recommended) leaves $626 for everything else.

- The bottom line? A shortfall of $400 per month. Cut out giving to charity (5%). You’re still 22% over budget. How would YOU re-allocate?

- Will balancing this budget work in the real world?

Mary Johnson’s Budget

$12/hour: Annual Gross Income $24,960: Monthly Gross Income $2,080

How about now? In Lake County, a household between 1-4 people with this total income would be considered Very Low Income. Let’s look at this theoretical budget:

- Do you think $12/hour is a generous wage?

- Could YOU “make it” on that income?

- Which category still looks low?

- Ask others what they think.

- Spending 40% of gross monthly income on rent (10% more than recommended) leaves $1,240 for everything else.

- The bottom line: a shortfall of $216 per month.

- What would you cut to make the budget work?

- While it might work on paper, would it work in the real world? What happens if this person’s vehicle needs a big repair?

Just how high an income do you need to only pay 30% for a 1 BR home at an FMR of $840?

James Smith’s Budget

$18/Hour: Annual Gross Income $37,440: Monthly Gross Income $3,120

- Finally! A “break even” income is about $18/hour.

- Paying only 27% of gross monthly income means having $96 leftover.

- Check the on-line job sites…how many offer this level of pay?

- At this income, would you upgrade to a 2 BR rental? Glance back at the very first chart; at $18/hour, renting a 2 BR home would mean being in the hole $64 each month.

Closing Thoughts

These budgets are based on gross income, but no one takes home 100% of that gross amount. By not factoring in typical withholdings, the budgets are skewed to the ‘generous’ side. What happens if you recalculate based on take-home pay? Try this calculator, then play with these budgets. What do you learn?

The ultimate takeaway for all of us? A viable, vibrant local economy means people have some financial room (sometimes called ‘margin’) each month because housing, the single biggest expense, is affordable. For that to be the case, income has to go up, or expenses have to go down, or we need a combination of those. How would that happen? If you have employees, it could mean studying your pay scale and having frank conversations with your employees about their situations, how their wages play out in the sample budgets, and whether budgeting classes would be helpful. As an individual, are you tracking expenses? Do you need a budgeting class? What do you need to do to move to a higher-paying position? Who could help you?

And, of course, this is Habitat’s newsletter…so consider contacting them to see about getting into an affordable home because that’s why they exist.

What other ideas come to mind? Share them with us on social media. We’d love to hear them!

Go on-line and look for one or two bedroom rentals in the area at the FMR levels. What do you see? Were you surprised by these sample budgets? Share them with young and old, with singles and widows. Have the hard conversations. Then, re-visit the budgets as if they were your own; what would happen if you had to suddenly pay for a significant car repair or out-of-pocket medical expense? We’d love to hear about what you learned in this process.